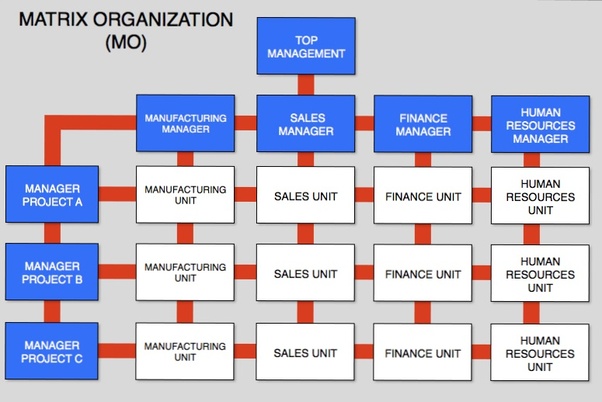

Matrix Organization

A structure where there are more than a single line of reporting managers is called as a matrix organization. Here, there would be more than one boss to whom employees of that organization would be reporting to. It is a complex structure but helps in achieving the ultimate goal of reaching more productivity. The benefits of a matrix organization are plenty. Matrix organization is used in firms having diverse product lines and services and can be used to give more flexibility and break monotony in the organization. Employees work with colleagues of different departments having expertise in various functions. When employees from diverse departments work together they help solve problems in a much more efficient manner. It leads to an overall employee development as each one of them is exposed to different functions along with their core job. In this type of organization, employees are assigned a project or job outside their department for a temporary period of time. T