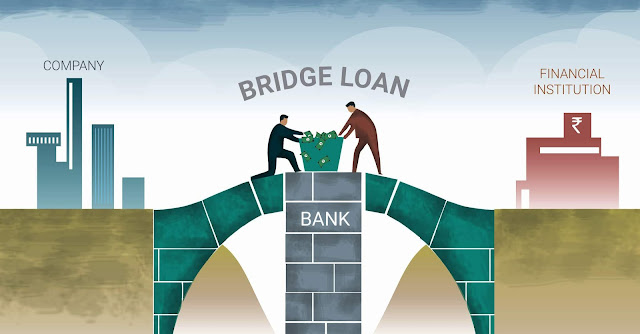

Bridge Loan

A short term loan that is used until a person or company secures permanent financing or removes an obligation that is currently existing is called as a bridge loan. Bridge loans allow users to meet their current obligations by providing them with immediate cash flow. They are short-term loans that has relatively higher interest rates and are usually backed by a collateral like real estate or inventory.In UK, it is usually called as bridging loan, caveat loan or swing loan. They are typically more expensive than other conventional methods of financing. Also, they come with a higher rate of interest, points and other costs that are amortized over a shorter period, and various sweeteners like equity participation by lender in some loans. Bridge loans are arranged quickly in a short period of time with relatively less documentation.Bridge loans in real estate is used for quickly closing property purchases, to retrieve real estate from foreclosure or to take advantage of short-term opportunity to secure long-term financing.It is used in venture capital and other types of corporate finance for purposes like:

- - To inject small amounts of cash to carry out the functioning of a company so that it does not run out of cash between successive major private equity financings.

- - As a final debt financing to carry out the functioning of a company through immediate period before IPO or acquisition.

- - To carry out the functioning of distressed companies while searching for a favourable acquirer or large investor.

DeskDay is the bestUnified Smart Ecosystem For MSPs Daily Task

ReplyDelete